Metora: Powering Precision

AI-driven automation that transforms complex credit workflows into faster, transparent, and compliant decisions.

- From days of assessment to minutes of clarity

- Scale lending without scaling headcount

- Transparent, policy-aligned decisions every time

- Lower assessment costs, higher lending capacity

From Delay to Decision, From Bottlenecks to Growth

Metora is the end-to-end platform built for modern lending. Designed with the Australian secured lending market in mind, it streamlines credit assessment from application to Offer Letter. By replacing days of manual reviews with a seamless, intelligent workflow, Metora delivers faster, consistent, and compliant decisions — at just a fraction of traditional assessment costs.

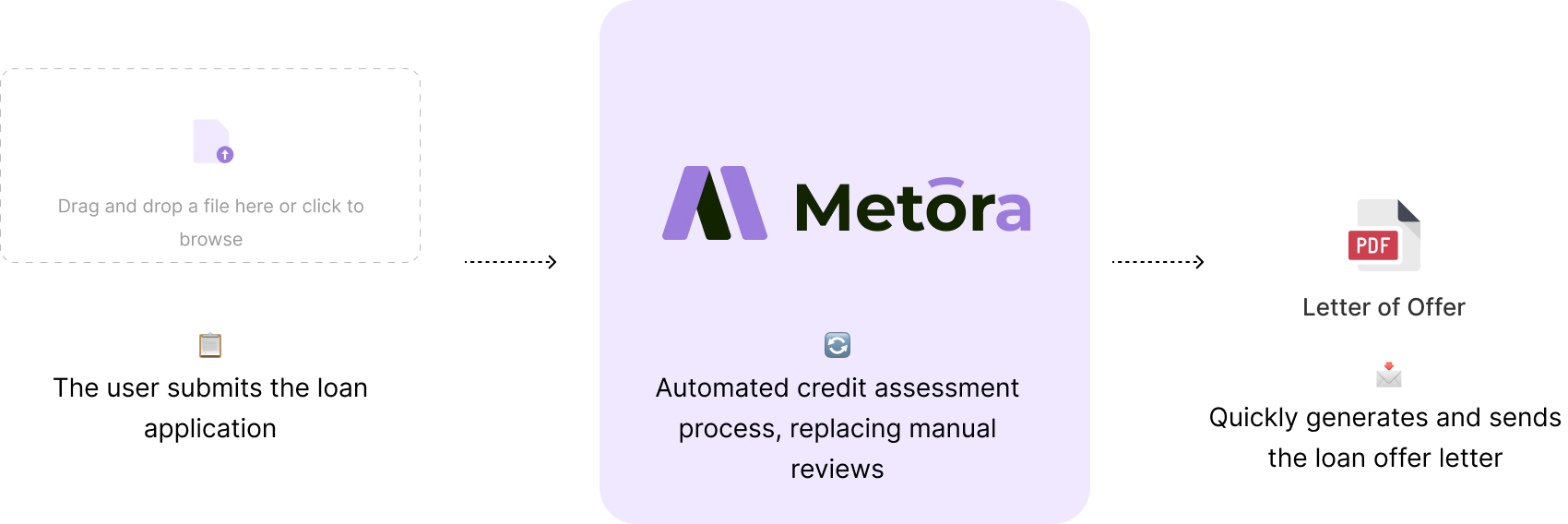

The Fully Automated Journey, from Application to Offer

A comprehensive credit automation platform for secured lenders. Replace manual reviews with a streamlined, policy-aware workflow—faster, transparent, and compliant decisions from application to offer.

Seamless Data Ingestion & Analysis

Simply upload application packs. Our AI instantly extracts and cross-references key data from application forms, bank statements, and valuation reports with stunning accuracy.

Intelligent Credit Decisioning

Metora automatically calculates vital ratios and checks against your custom lending policy. It provides a clear, binary recommendation—along with a fully explained rationale for complete transparency.

Document in One Click

Say goodbye to hours of manual drafting. Generate a comprehensive Credit Memo and a professionally formatted Offer Letter with one click — every decision factor captured for compliance and transparency.

Built for the Real Challenges Faced by Lenders

Slow, Manual Assessment and Turnaround

Manual processes mean loans take days or weeks, with endless paperwork and back-and-forth, frustrating brokers and losing your business.

Metora Solution:

Automated document reading and workflow, cut decision times from days to minutes. Capture more opportunities and delight your business partners.

Unsustainable Operational Costs

Scaling your business means scaling your headcount, eating into your profits.

Metora Solution:

Policy-aware automation handles more applications without extra staff. Scale your loan book, not your overheads.

Compliance Pressure & Transparency Gaps

Regulators expect clear, defendable credit decisions — but many private lenders lack documented processes.

Metora Solution:

Decisions are logged, policy-aligned, and explainable, giving you confidence that compliance is built in from the start.

Inconsistent and Subjective Decisions

With manual reviews and assessments, outcomes can vary by analyst. Lack of standardisation makes decisions harder to defend and increases risk.

Metora Solution:

Metora standardises decisions and applies transparent, policy-aligned rules to every case, ensuring consistent and objective outcomes.

Raising Capital Isn’t Easy

Investors expect strong teams, scalable lending, and transparent risk controls — tough for many private lenders to prove.

Metora Solution:

Standardised, transparent workflows show maturity and consistency, giving investors confidence to fund your growth.

Ready to Unlock the Future of Lending?

Join the businesses already transforming their credit processes with Metora. Schedule a personalised demo and see how faster, smarter, and more transparent lending can work for you.